Sector Update / Consumer Discretionary / Click here for full PDF version

Author(s): Lukito Supriadi ;Andrianto Saputra

- Accounting for earlier Lebaran seasonality which denotes higher GPM, /MAPI's lower GPM -68/-161bps yoy came below expectations.

- Sustained low mall occupancy rate in mid-low tiered malls led to some stores' underperformance for retailers like and .

- Retailers' base effect in 2Q23 are deemed to be less favorable compared to staples', in our view. Maintain sector Neutral call.

1Q24 recap: was the outperformer

Although 1Q24 retailers' earnings were optically positive (Fig. 7), we note that the underlying performance of /LPPF/MAPI may miss consensus and our estimates accounting for the earlier Lebaran. has also shared that its Lebaran festive SSSG of -2.4% is below management's expectations; and that the Lebaran's festive revenue would be somewhat evenly distributed between 1Q24 and 2Q24. On the other hand,despite the earlier Lebaran/MAPI booked -68/-161bps yoy lower GPM in contrast of the typically higher GPM of +64/+44bps qoq for /MAPI during the Lebaran quarters in the past 5yr ex-Covid(Fig 12). was the clear outperformer in 1Q24, driven by their strong sales recovery momentum.

Low occupancy rate in mid-low tiered malls leading to some stores' underperformance for /ACES

One key factor on mid-lower class retailers' underperformance may be due to delayed recovery in mid-low tier mall's occupancy rate. According to Colliers' data, G. Jakarta mall occupancy levels in mid/low tiered malls stood at only c.70/50% as of 1Q24. Based on our channel checks, this trend may partially be attributed by consumers' rising adoption of e-commerce. This has led to a portion of 's stores dragging down performance (29 under watchlist and 10 planned for closure - these 39 stores are c.25% of total stores). A similar trend (although far less significant) is being cited by pertaining to their 10 underperforming stores (4.2 % of total stores) - these stores are located in 2ndtier malls in Jakarta/Java. From this standpoint, may be the most resilient as its stores' locations are focused in 1sttier malls.

Retailers' base effect for 2Q24 is less favourable compared to staples

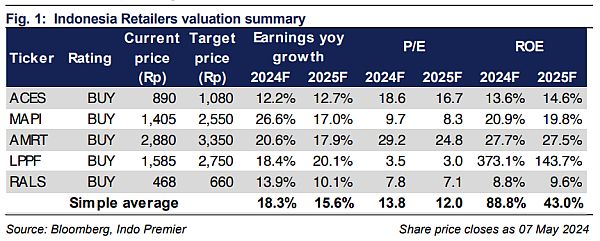

Looking ahead, we note a general distinction between retailers and staples. While 2Q23 represents a low base effect for staples (report), 2Q23 were far more normalized for /MAPI given their 2Q23 SSSG of 8.9/7.7%.Nonetheless, recently shared that indicative Apr24 SSSG is positive despite Apr23's 15.0% SSSG . On the other hand, we expect to continue its strong SSSG for Apr24.In sum, we maintain our Neutral call on the sector with pecking order: > > > > .

Sumber : IPS